How much does a business energy storage system cost (50 kW/108 kWh → 3.85 MWh container)?

Energy storage system cost for business: CAPEX/OPEX drivers, 50 kW/108 kWh to 3.85 MWh containers, and how to compare BESS quotes.

How much does a business energy storage system cost (50 kW/108 kWh → 3.85 MWh container)?

A business energy storage system cost is driven mainly by power (kW), capacity (kWh/MWh), and the integration and grid-connection scope, so the same “battery size” can be priced very differently depending on how it must work on site. This guide is for CFOs, procurement managers, and facility managers in SMB manufacturing who need to budget CAPEX, understand OPEX impacts, and compare vendor quotes fairly. You’ll learn what to expect in typical line items, what questions to ask, and how to quantify savings (peak shaving, self-consumption, arbitrage) using your own data.

In Poland (and broadly in Europe), 2026 is also a year where distribution charges and regulated components are rising, while energy wholesale/sales components may trend lower—a mix that makes well-designed BESS projects increasingly about reducing peaks and controllable fees, not only buying cheaper kWh (Energy Solution, Gramwzielone.pl, Enerad).

BESS cost — Overview (what you really pay for)

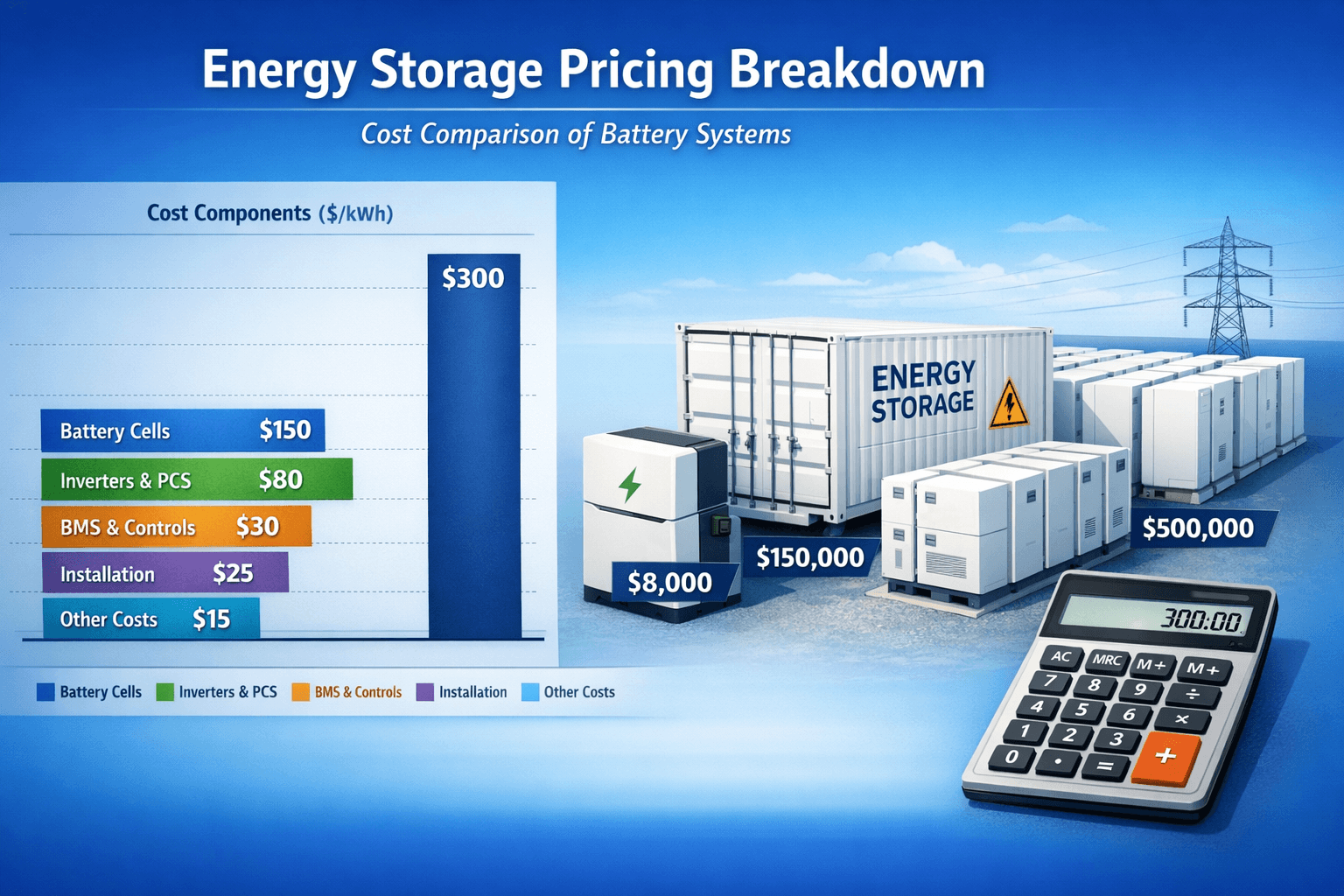

When people ask for “BESS price” or “commercial battery cost”, they often mean the battery cabinet/container. In real projects, the total energy storage system cost includes several layers:

- Battery system (cells, racks, BMS) — the electrochemical storage

- Power conversion (PCS/inverters) — how many kW you can charge/discharge

- Thermal management — air/liquid cooling, heating, ventilation

- Safety & compliance — fire protection, sensors, emergency stop, certifications

- Balance of plant — transformers, switchgear, cables, protection devices

- Software & energy management — monitoring, scheduling, forecasts, reporting

- Engineering & commissioning — design, grid studies, tests, handover

- Civil works & logistics — foundations, crane, transport, site prep

Power (kW) vs capacity (kWh): the simplest pricing intuition

A quick way to understand quotes is to separate two “sizes”:

- Power (kW) = how fast you can push energy in/out (impacts PCS, cables, switchgear)

- Capacity (kWh/MWh) = how much energy you can store (impacts battery modules)

A 50 kW / 108 kWh system is roughly a 2-hour system. A 3.85 MWh container can be configured at different power ratings (e.g., 1 MW, 2 MW), changing the economics and price structure significantly.

A realistic “from–to” context (Poland/CEE)

Public price references are often clearer for small systems than for industrial containers. For example, a Polish market overview cites that energy storage systems around 20 kWh can cost 45,000–67,000 PLN with installation (consumer/small scale), and that commercial BESS CAPEX for business-grade systems starts higher as scale and requirements increase (Energetyczny Projekt). For larger, containerized systems (MWh-scale), the industry reality is that pricing becomes project-specific—typically hundreds of thousands to millions in local currency—because grid connection and integration dominate the bill of materials.

For procurement, the practical takeaway is: don’t compare “battery price per kWh” alone. Compare delivered, connected, warranted, commissioned systems with the same scope.

How to choose a business energy storage system (what affects the price)

1) Application drives architecture (and cost)

The same battery can be sold into different use cases:

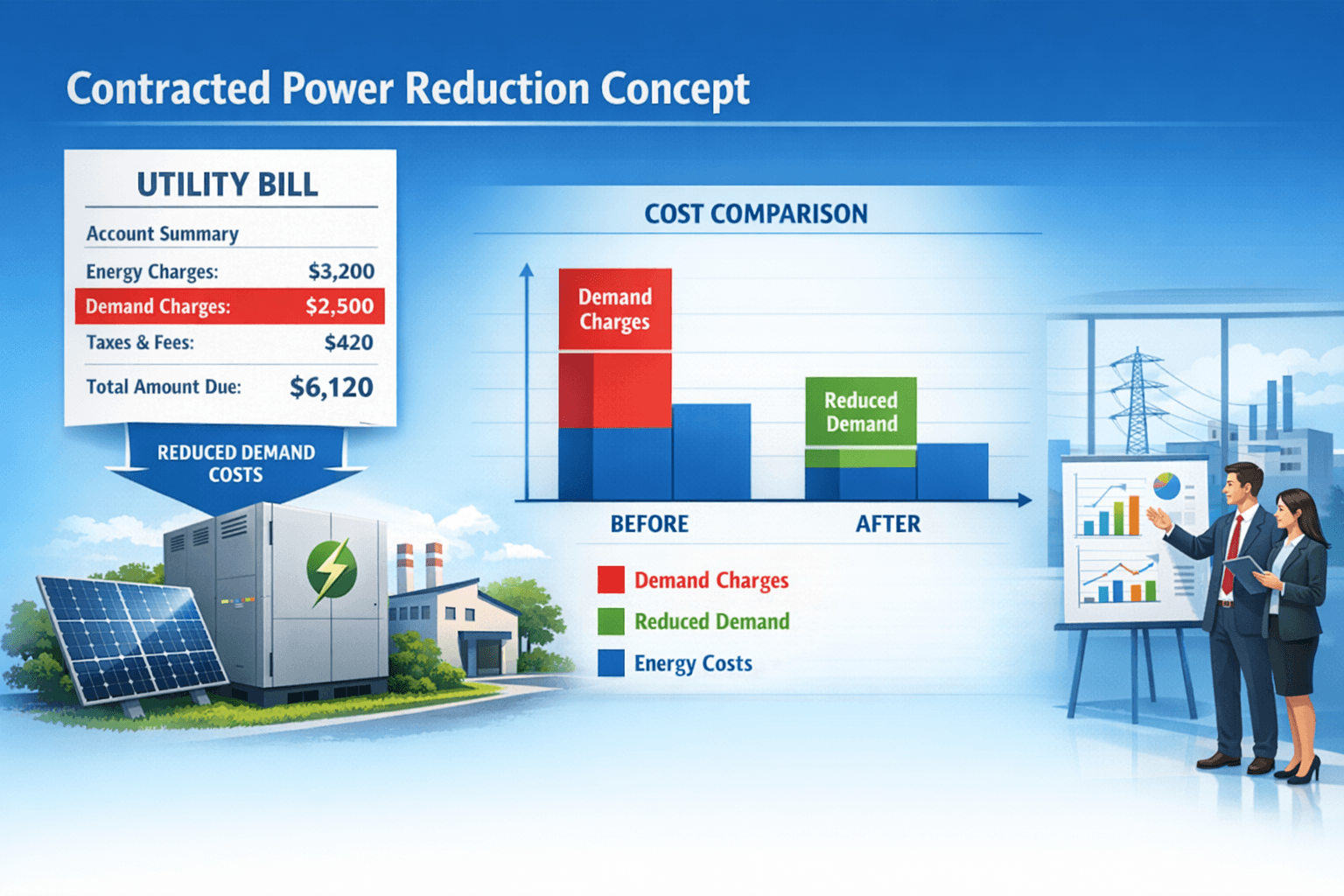

- Peak shaving / demand management (reduce max kW drawn from the grid)

- PV self-consumption (store solar and use it later)

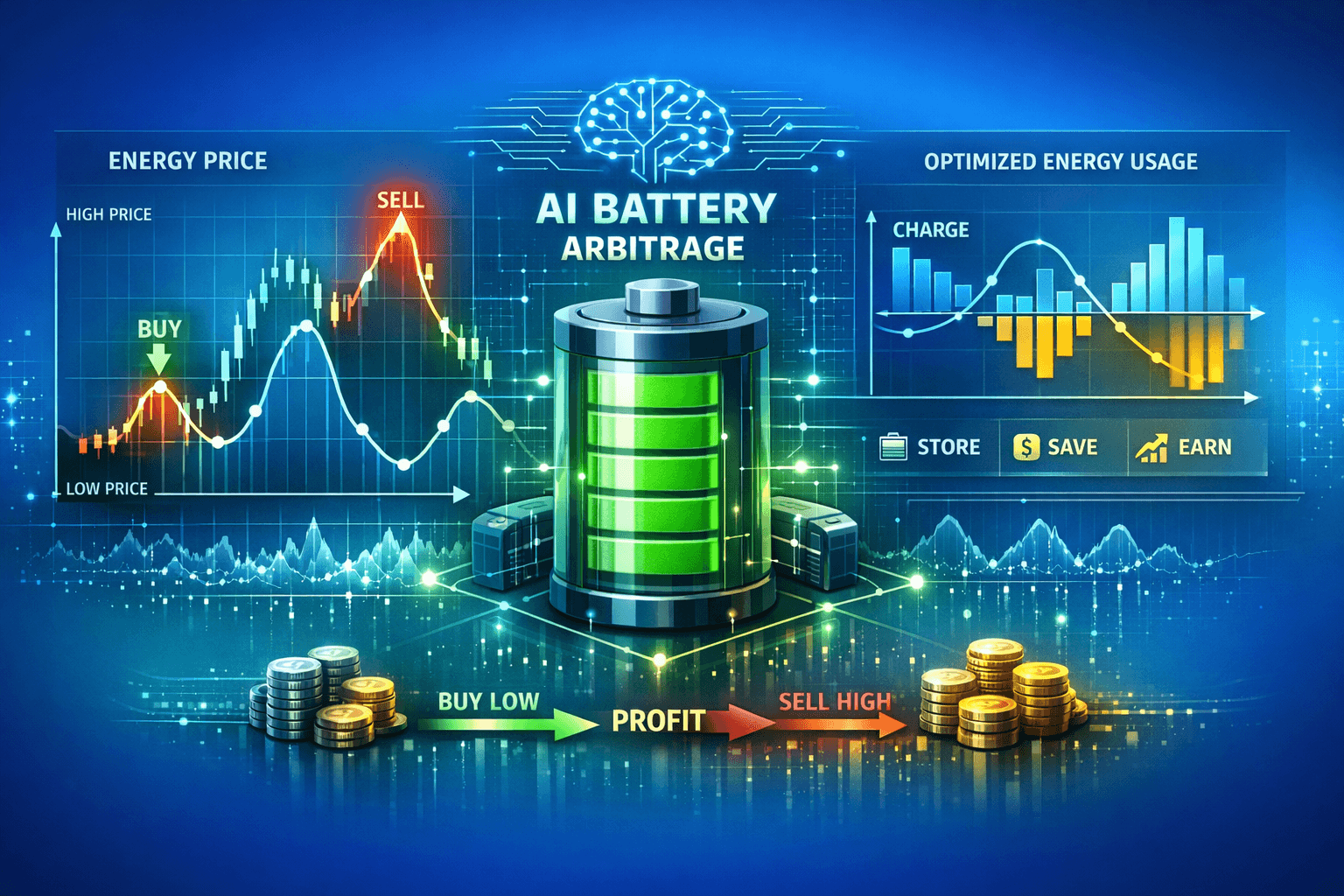

- Energy arbitrage (buy low, use/sell high—works best with dynamic pricing)

- Power quality / backup (ride-through, UPS-like behavior)

- Grid services (where regulations allow; requires metering and compliance)

Peak shaving usually demands:

- high reliability,

- fast response,

- accurate measurement,

- and smart control logic.

That means more integration and software—i.e., higher CAPEX, but often better savings.

2) Integration scope: “battery next to the wall” vs “system that runs your site”

Integration is where quotes diverge most. Consider the differences:

- Basic: battery + inverter, minimal metering, basic monitoring

- Advanced: full plant metering, tariff-aware scheduling, PV coordination, demand forecasting

- Enterprise: SCADA integration, cybersecurity requirements, power quality, redundant communications

In Polish pricing references, even at smaller scale, integration and smart controls are explicitly listed as a cost component (Energetyczny Projekt). At industrial scale, it’s often the difference between a battery that exists and a battery that delivers ROI.

3) Grid connection and electrical works (often underestimated)

For SMB manufacturing, the “hidden” part of business battery cost is frequently the electrical room:

- switchgear upgrades

- protection coordination

- cabling routes and installation complexity

- transformer constraints

- power quality mitigation

- utility requirements and documentation

These can add weeks to the schedule and meaningfully change CAPEX. They also influence OPEX indirectly: a better-designed connection can reduce downtime risk and improve performance consistency.

4) Warranty, performance guarantees, and degradation assumptions

Two systems with the same kWh nameplate can behave differently after 3–5 years.

In procurement terms, look for:

- Warranty terms (years, cycles, throughput)

- End-of-warranty capacity (e.g., 70–80% remaining)

- Operating window (temperature, C-rate constraints)

- Round-trip efficiency at your operating profile

If a quote is cheap but forces conservative operation (low power, narrow SOC window), your “usable” system is smaller than the datasheet.

5) OPEX: what you pay after commissioning

OPEX for a BESS project is usually modest compared with CAPEX, but it matters for ROI and risk:

- monitoring / software subscription

- preventive maintenance & inspections

- insurance requirements

- occasional component replacement (fans, filters; sometimes PCS parts)

- metering and data connectivity

And—most importantly for CFOs—your electricity bill structure.

In Poland, 2026 distribution-related charges are widely reported as increasing, including the capacity charge (opłata mocowa) and other regulated items (Energy Solution, GLOBENERGIA). That tends to increase the value of peak shaving, because avoiding peaks can reduce controllable cost components in many tariff structures.

At the same time, regulated tariff decisions point to an average electricity sales component around 495.16 PLN/MWh for 2026 in Poland (reported as a year-on-year decrease), which changes the balance between “buy cheaper energy” versus “avoid peaks and fees” (Gramwzielone.pl). For many SMB factories, the best business case becomes: peak shaving + PV self-consumption + smart scheduling, not arbitrage alone.

BESS price structure: a practical CAPEX checklist for comparing quotes

Use this checklist to normalize offers. If a line item is missing, clarify whether it’s included or excluded.

| Cost block | What it includes | Questions to ask procurement-safe |

|---|---|---|

| Battery + BMS | modules/racks, internal wiring, battery management | What is usable capacity vs nameplate? What chemistry? What is end-of-warranty capacity? |

| PCS/Inverter (kW) | bidirectional inverter, controls, harmonics | Is the kW continuous? Any derating at temperature? Grid code compliance? |

| Cooling & enclosure | HVAC or liquid cooling, heating, filters | Operating range and noise? Service intervals? |

| Safety | detection, E-stop, fire strategy, compliance docs | What standards and test evidence? Who is responsible for fire compliance on site? |

| Metering & controls | meters/CTs, data logger, EMS | How many metering points? Does it optimize peaks and tariffs automatically? |

| Electrical works | cables, protections, switchgear modifications | What is assumed about your existing LV/MV switchboard? What upgrades are included? |

| Civil works | foundations, fencing, container pad | Is a crane needed? Who pays transport and permits? |

| Commissioning | tests, training, handover documentation | What acceptance tests are included (functional, safety, performance)? |

| Warranty & service | SLA, remote monitoring, spare parts | Response time? Who owns performance risk? |

A note on “cheap per kWh” offers

If two quotes differ massively, it’s usually because:

- one includes grid connection/switchgear and the other doesn’t,

- one includes advanced control + metering and the other is “manual/basic”,

- or warranty assumptions differ (cycles/throughput).

For CFO-level comparability, always request a scope-of-supply matrix.

Cost benchmarks by size: what changes from 50 kW / 108 kWh to a 3.85 MWh container?

Rather than quoting a single number (which can be misleading), it’s more useful to understand how the cost drivers shift with scale.

Small commercial (example: ~50 kW / ~100 kWh)

Typical cost drivers:

- inverter/PCS and protections (because power is relatively high vs capacity)

- metering and integration (often the “make it work with my factory” part)

- installation complexity (electrical room constraints)

This segment is often chosen for:

- peak shaving in SMB manufacturing

- shifting PV surplus to evening

- stabilizing bills under variable tariffs

Polish market references indicate that even smaller systems (like ~20 kWh) have a wide installed cost range and that installation/inverter/integration are meaningful components (Energetyczny Projekt). That same principle scales upward.

Industrial / containerized (example: ~3.85 MWh container)

Typical cost drivers:

- grid connection (LV vs MV), transformer/switchgear scope

- civil works and site preparation (container pad, access, safety perimeter)

- compliance, documentation, and testing

- operational strategy (what the container is supposed to do every day)

Containers are often procured for:

- large industrial sites

- PV farms (curtailment reduction, time-shifting)

- multi-site portfolios (standardized rollouts)

At this size, procurement should treat the project like infrastructure: scope, compliance, and performance guarantees matter more than “hardware price”.

Energy storage system cost: how to compare quotes (a CFO/procurement method)

Step 1: Normalize the technical scope

Ask each bidder to fill the same one-page sheet:

- kW (continuous, peak, duration)

- kWh (nameplate and usable)

- round-trip efficiency (at what power and SOC window)

- degradation assumption (annual % or throughput-based)

- grid connection point (LV/MV, protection scope)

- included metering points

- included software functions (peak shaving, tariff optimization, PV optimization)

Step 2: Compare warranties in business terms (not marketing terms)

A procurement-friendly way:

- Convert warranty to an expected delivered energy throughput (MWh over life).

- Compare cost per warranted throughput, not cost per nameplate kWh.

Step 3: Compare total cost of ownership (TCO), not CAPEX

TCO = CAPEX + service + software + planned maintenance + insurance impacts + (optional) financing costs.

Also quantify:

- savings from reduced peaks

- improved PV self-consumption

- avoided production disruptions (if relevant)

In Poland, where distribution cost components are reported to rise in 2026, the value of demand management can increase (Energy Solution, GLOBENERGIA).

Step 4: Use your data (otherwise you’re guessing)

Even a perfect quote comparison won’t tell you ROI if you don’t model:

- your load profile (15-min or hourly)

- tariff structure

- contracted power / maximum demand

- PV generation profile (if you have solar)

That’s why we always recommend a quick ROI check on real intervals.

What data do you need to calculate ROI?

To accurately calculate energy storage savings, you need:

- Energy consumption profile (hourly or 15-minute intervals) or invoices + interval data

- Tariff / pricing model (fixed vs dynamic)

- Contracted power / peak demand information

- Existing PV installation details (kWp, production, self-consumption)

AIESS approach: reducing “integration risk” with 100% automatic control

Many BESS projects fail to hit expected savings not because the battery is bad, but because:

- scheduling is manual or too conservative,

- tariffs aren’t modeled correctly,

- peaks are missed,

- PV coordination is suboptimal.

AIESS is built around the opposite idea: make energy storage easy-to-use and easy-to-implement, and let the system optimize continuously.

Why AIESS?

AIESS energy storage systems stand out with:

- AI Control - automatic charge/discharge scheduling

- Forecasts - energy prices, weather, load predictions

- 24/7 Monitoring - savings reports and continuous optimization

A simple decision framework: which size makes sense for SMB manufacturing?

Below is a practical sizing lens for early-stage budgeting (not a substitute for engineering).

| Site situation | Typical goal | What usually matters most | Common “right answer” |

|---|---|---|---|

| High short peaks (machines, compressors) | Peak shaving | kW, response time, metering accuracy | Higher kW relative to kWh |

| PV already installed, evening load | Self-consumption | kWh, daily cycling, efficiency | 1–3 hours storage duration |

| Dynamic pricing exposure | Arbitrage + peak shaving | forecasting + automation | Software and control quality |

| Grid constraints / curtailment (PV farm) | Time-shifting | kWh/MWh + interconnection scope | Containerized MWh-scale |

If you’re unsure, start with measurement: one week of 15-minute intervals is often enough to estimate peak shaving potential reliably.

FAQ (Frequently Asked Questions)

-

What is the biggest driver of commercial battery cost: kW or kWh?

Both matter, but in many SMB projects, power (kW) and integration drive cost as much as capacity. A “cheap kWh” battery can become expensive once you add PCS, switchgear upgrades, and commissioning. -

Can I compare offers using price per kWh?

Only as a rough filter. For a fair comparison, use price per usable kWh, include the same scope (electrical works, metering, EMS), and consider warranty throughput. -

Why do two 50 kW / 100 kWh quotes differ so much?

Usually because of different assumptions about grid connection scope, metering points, software functions, and warranty terms. Ask for a scope matrix and clarify exclusions. -

How do distribution charges in 2026 affect BESS ROI?

Reported increases in distribution-related components can make peak shaving more valuable, because part of the bill is tied to demand/regulated fees rather than pure energy price (Energy Solution, GLOBENERGIA). -

If energy prices are falling, does storage stop making sense?

Not necessarily. Many business cases are driven by peaks, operational stability, and PV self-consumption, not only buying cheaper energy. Also, wholesale price expectations can differ by contract type and hours (Enerad). -

What should I demand in a warranty for business energy storage?

Look for clear terms on years, cycles/throughput, end-of-warranty capacity, and what happens if the system underperforms. Ask who is responsible for diagnosis and service. -

Is a container (MWh-scale) always cheaper per kWh than a small system?

The battery hardware often benefits from scale, but total project cost can be dominated by grid connection and civil works, especially on MV. So “cheaper per kWh” is not guaranteed at the site level. -

What is the fastest way to estimate ROI without a full tender?

Use your interval consumption data (and PV data if you have it) in a calculator to get a first-pass savings range, then refine during technical design. Calculate ROI →

Summary

Business energy storage system cost is not a single number—it’s the sum of battery + power electronics + integration + grid connection + commissioning, with warranty and software determining how much of that nameplate value you can actually monetize. For SMB manufacturing, the best financial outcomes typically come from projects that prioritize peak shaving, PV self-consumption, and automatic tariff-aware control, especially in an environment where distribution-related charges are rising (Energy Solution, GLOBENERGIA).

Next steps

-

Quantify your opportunity on real data (15-minute or hourly profile).

Calculate ROI on your data → -

If you’re collecting offers, use the CAPEX checklist above and require a scope-of-supply matrix.

-

If you want an AI-controlled system that is 100% automatic, easy to implement, and designed for fast ROI in real-world factories:

See AIESS solutions →

Related articles

- What is an ESS (Energy Storage System) and how does it work?

- Peak shaving with battery storage: a practical guide for factories

- How to size a battery for PV self-consumption in a business

- Dynamic electricity pricing: when does arbitrage with BESS work?

Sources and References

Article based on data from:

-

Energetyczny Projekt (2026). “Ile kosztuje magazyn energii w 2026 roku?”

https://energetycznyprojekt.pl/ile-kosztuje-magazyn-energii/ -

Energy Solution (2026). “Koszty dystrybucji energii 2026 - o ile wzrosną?”

https://www.energysolution.pl/koszty-dystrybucji-energii-2026/ -

GLOBENERGIA (2026). “Podwyżka kosztów dystrybucji energii. Ile zapłacisz w 2026 roku?”

https://globenergia.pl/podwyzka-kosztow-dystrybucji-energii-ile-zaplacisz-w-2026-roku/ -

Gramwzielone.pl (2026). “Ceny energii elektrycznej w 2026. Miało być poniżej 500 zł/MWh i jest.”

https://www.gramwzielone.pl/trendy/20345200/ceny-energii-elektrycznej-w-2026-mialo-byc-ponizej-500-zl-mwh-i-jest -

Enerad.pl (2026). “Małe i średnie firmy coraz częściej wybierają stałe ceny energii.”

https://enerad.pl/male-i-srednie-firmy-coraz-czesciej-wybieraja-stale-ceny-energii-zmiana-trendu-na-rynku-msp/

Last updated: January 7, 2026