ESS + PV for business: self-consumption, surplus and charging strategies

ESS + PV strategy comparison: self-consumption, PV surplus storage, grid charging and hybrids—choose what fits your site and maximize savings.

ESS + PV for business: self-consumption, surplus and charging strategies

The best ESS + PV strategy for a business is the one that turns the most expensive kWh you would have bought from the grid into on-site energy—either by increasing self-consumption, avoiding low-value exports, shaving peaks, or doing all of these with a hybrid approach. This article is for facility managers with PV installations, energy managers, and sustainability officers who want practical guidance without getting lost in battery jargon. You’ll learn when PV surplus storage wins, when grid-charging (arbitrage/peak shaving) makes sense, and how hybrid control often delivers the most stable savings.

In other words: the battery is not “just capacity”—it’s a scheduling tool. The real differentiator is how your energy management system (EMS) decides when to charge and discharge to match your tariffs, load profile, and PV generation window.

What is an ESS with solar (PV)?

An energy storage system (ESS)—often called battery energy storage (BESS)—is a battery plus power electronics (inverter), controls (EMS), and safety systems that can store electricity and later use it on-site.

When paired with solar PV, ESS typically adds three business outcomes:

- Higher self-consumption: use more of your own PV instead of exporting it.

- Lower peak demand: reduce short, expensive peaks that drive charges (where applicable).

- More control: decide whether to store PV surplus, charge from the grid, or run a hybrid schedule.

A common misconception is that PV + battery automatically equals “near total independence.” In reality, the best results come from matching a strategy to your site’s constraints: tariff structure, export compensation, operating hours, and how peaky your loads are.

How does ESS + PV work in practice?

At a high level, the battery sits “behind the meter” and the EMS chooses one of three actions each moment:

- Charge (from PV surplus, from grid, or both—depending on rules)

- Discharge to supply loads (reducing imports)

- Idle (do nothing because charging/discharging would be uneconomic or constrained)

The three basic operating modes

-

PV surplus storage (self-consumption mode)

Charge primarily when PV exceeds site demand, then discharge later to cover evening or high-demand periods—reducing exports and grid imports. This is the classic “store surplus at noon, use after hours” approach described widely for solar + storage control strategies (Energy Toolbase, Solar-Electric.com). -

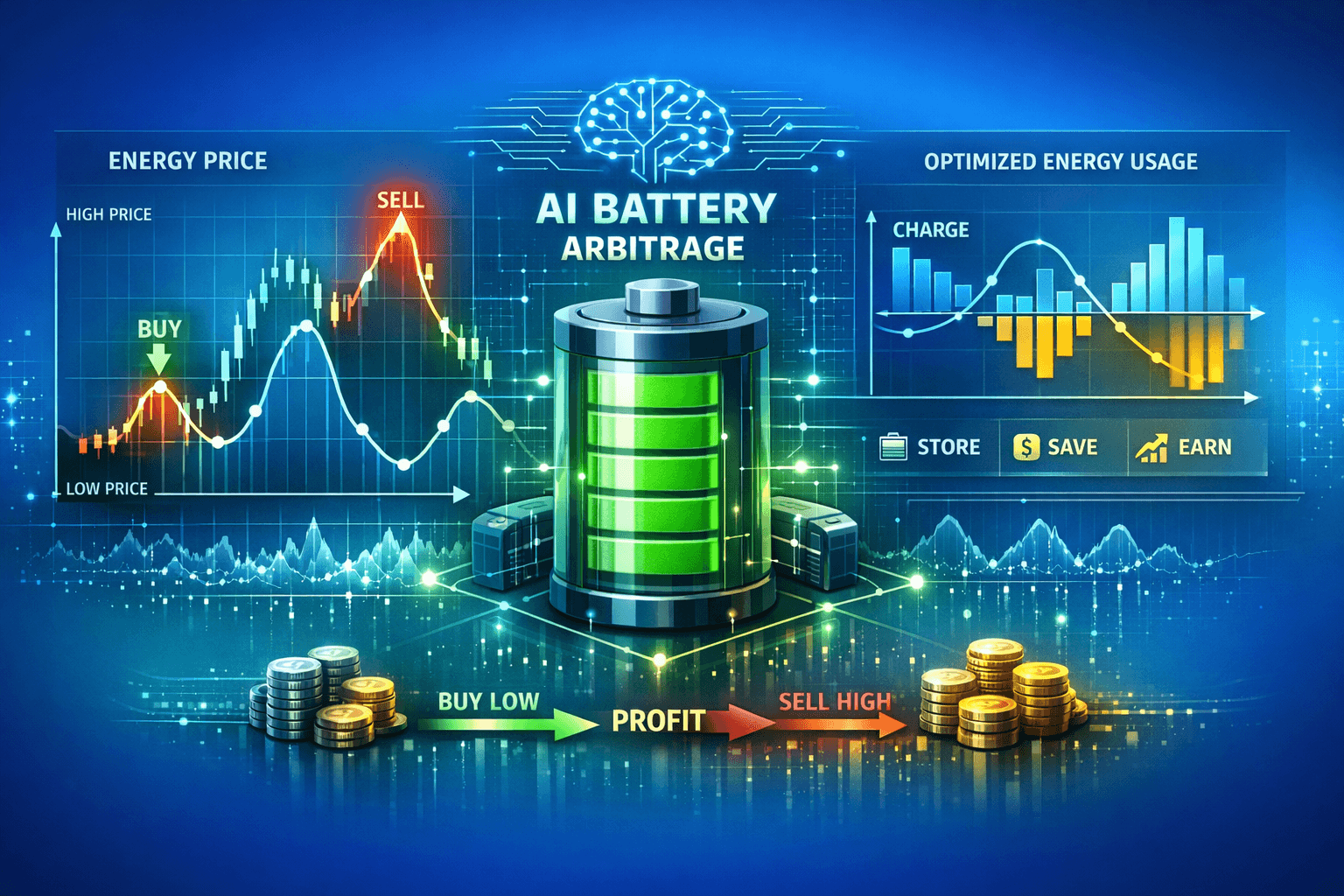

Grid charging (arbitrage + peak shaving)

Charge when electricity is cheap (off-peak / overnight / low day-ahead prices) and discharge when electricity is expensive or when your load spikes. Commercial ESS value often comes from this mix of tariff arbitrage and demand reduction (Mayfield Renewables). -

Hybrid (PV surplus + grid charging + smart constraints)

Use PV surplus first, but allow grid charging when it improves economics or ensures the battery is ready for a peak period. Many commercial EMS frameworks present hybrids as the most flexible because they can “stack” value streams (Energy Toolbase, AlphaESS).

A quick diagram in words (typical day)

- Morning: PV ramps up, site load starts.

- Midday: PV exceeds load → either export or charge battery.

- Afternoon: PV drops; if loads remain, battery can support.

- Evening: PV low; battery discharges to reduce imports and/or shave peaks.

- Night: optional grid charge if off-peak is cheaper or to prepare for the next day.

Applications of ESS with solar in commercial sites

ESS + PV isn’t one use case—it’s a set of levers you can pull depending on how your facility behaves.

1) Self-consumption improvement (use more of your PV)

If your PV often produces more than your instantaneous load (common in offices, logistics, schools, or any site with a “midday surplus”), battery storage can capture that surplus and increase self-consumption materially (Solar-Electric.com, Anern).

2) Export avoidance when feed-in is low

Many markets have moved away from generous net metering. When exported energy is compensated poorly relative to retail imports, storing surplus becomes more attractive.

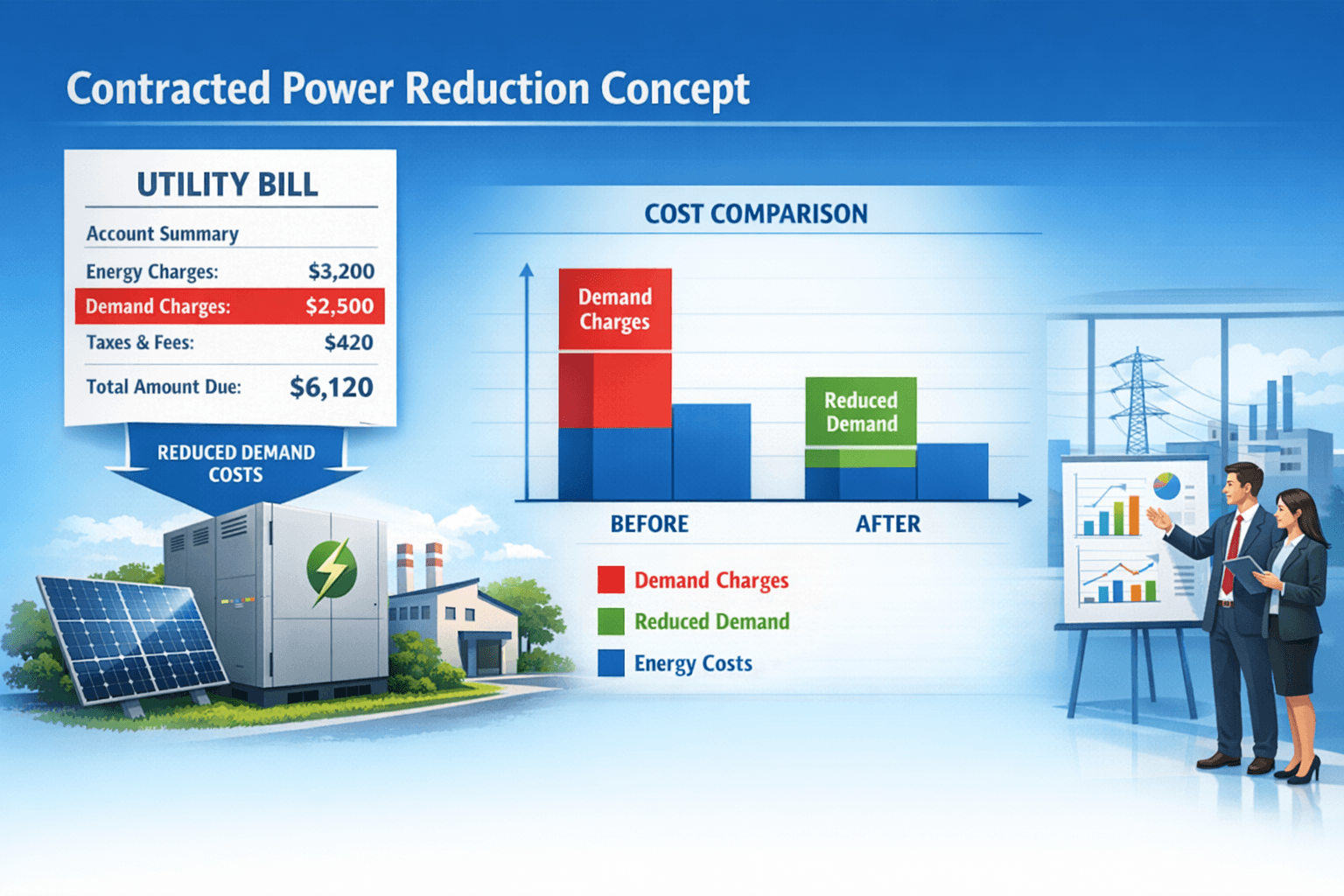

3) Peak shaving (reduce short spikes)

Some businesses don’t have much PV surplus, but they have costly peaks (e.g., machinery start-up, HVAC ramps, large pumps, process loads). In these cases, a battery that discharges for a few minutes to hours can reduce peak-driven costs—often one of the top commercial value drivers (Mayfield Renewables).

4) Tariff arbitrage (charge cheap, use expensive)

With time-of-use or dynamic prices, grid charging can deliver savings even if PV surplus is limited—especially when you can reliably predict low-price windows.

5) Operational resilience (limited backup)

Many on-grid ESS setups can also provide partial backup/UPS-like support depending on design. This isn’t the main focus of this strategy article, but it can be an additional value stream.

Benefits of ESS + PV strategies (what you actually gain)

A good ESS + PV strategy is less about “battery size” and more about turning variability into predictable savings.

Key business benefits include:

- Lower energy bills by replacing imported kWh with stored PV or off-peak kWh.

- Higher PV value by reducing exports at low compensation.

- Better cost predictability under volatile markets (hybrid scheduling can smooth exposure).

- Grid-friendly operation by reducing reverse power flow from PV export and limiting peak imports (a point often discussed in distributed solar + storage contexts, including references to improved self-consumption impacts (Anern)).

Strategy 1: PV surplus storage (solar self-consumption mode)

If your PV regularly exceeds your load for hours, PV surplus storage is usually the first strategy to evaluate.

How it works

- The EMS prioritizes direct PV to loads.

- When PV exceeds load, the battery charges instead of exporting.

- Later, the battery discharges when PV is low and the facility still consumes energy.

This “export prevention / self-consumption” strategy is a standard solar + storage control mode (Energy Toolbase).

When it makes the most sense

PV surplus storage fits best when:

- You see consistent midday export (surplus).

- Your facility has late afternoon/evening consumption (or any non-PV hours load).

- Export compensation is meaningfully lower than retail import prices.

Practical example table (from real operational logic)

| Scenario | Without ESS | With ESS (PV surplus mode) |

|---|---|---|

| Daytime PV peak | Export surplus to grid | Store surplus in battery |

| Evening demand | Import from grid | Battery discharge covers loads |

This pattern is the core reason solar + storage increases self-consumption and reduces grid reliance (Solar-Electric.com, Anern).

Common pitfalls (why ROI disappoints)

- Battery too small: it fills quickly and you still export much of the surplus.

- Battery too large: you paid for capacity you can’t cycle often enough.

- Weekends/seasonality ignored: if your load drops on weekends, your “surplus” may be huge and you’ll still export unless the strategy includes weekend rules.

- No load shifting: sometimes the cheapest kWh is the one you shift (e.g., move HVAC pre-cooling or EV charging into solar hours).

Sizing note (why “100% self-consumption” is a trap)

Research and industry discussion show that reaching “100% self-consumption” depends on careful sizing and operational constraints—and in some approaches it’s framed around system design that avoids exporting at all (PV Magazine). For most businesses, the practical goal is not perfection; it’s maximum profitable self-consumption.

Strategy 2: Grid charging (arbitrage + peak shaving)

Grid charging means the battery is sometimes filled from the grid, not just from PV.

How it works

- Charge during low-price hours (off-peak tariffs or predicted low day-ahead prices).

- Discharge during expensive periods or to reduce peaks.

- PV, if present, is still used directly; the battery can be reserved for peaks.

Commercial ESS value often comes from stacking arbitrage and demand reduction (Mayfield Renewables).

When it makes sense (even if you already have PV)

Grid charging becomes attractive when:

- Your PV doesn’t create much surplus (PV mostly matches load).

- You face time-of-use rates or dynamic pricing.

- Your site has short, expensive peaks.

- You can forecast price and load well enough to avoid “charging at the wrong time.”

Many EMS value-capture frameworks list arbitrage and peak reduction as key levers for commercial storage economics (Energy Toolbase, Mayfield Renewables).

The trade-off to be aware of

If you charge from the grid and later discharge, you pay for:

- Round-trip losses (you don’t get 100% back),

- and potentially battery wear (more cycles).

That’s why grid charging should be used only when the spread between cheap and expensive energy (plus peak reduction value) is large enough.

Strategy 3: Hybrid (PV surplus + grid charging + smart EMS)

Hybrid strategy is what many commercial sites end up using because it’s the most flexible: store PV surplus when it exists, but also allow grid charging when economics and constraints justify it.

How it works (simple rules)

A hybrid EMS typically applies priority rules such as:

- Use PV for loads first (always).

- Charge from PV surplus when available (to reduce exports).

- Reserve battery for a known expensive window (peak tariff or peak load period).

- Grid charge only if it improves total savings (e.g., to prepare for peaks or if tomorrow’s PV forecast is low).

This concept of EMS optimization and value stacking in solar + storage is widely described in commercial storage guidance (Energy Toolbase, AlphaESS).

Why hybrids often win in real facilities

Hybrids reduce “single-point dependency”:

- If PV surplus is low (cloudy week, winter), you still have arbitrage/peak shaving options.

- If prices are flat, you can prioritize self-consumption and export avoidance.

- If your load shifts (new machinery, new operating hours), hybrid rules can adapt.

Why AI control matters (and why “manual schedules” fail)

A fixed schedule like “charge 10:00–14:00, discharge 17:00–21:00” breaks as soon as:

- clouds reduce PV,

- production adds a new shift,

- tariff structures change,

- or your peak moves.

AIESS systems are built around AI-driven automation: forecasting PV generation, load patterns, and price signals to keep the battery schedule profitable without daily manual tuning. That means easy-to-use, easy-to-implement, and designed for “set it and forget it” operation—exactly what facility and energy managers need when energy optimization is not their core job.

Comparison: which ESS + PV strategy should you choose?

Use this table as a decision shortcut before you go into detailed ROI modeling.

| Strategy | Best for | What it mainly optimizes | Typical “tell” in your data |

|---|---|---|---|

| PV surplus storage | High midday PV surplus + later demand | Self-consumption, export avoidance | Regular exports at noon; imports after PV hours |

| Grid charging | Strong ToU/dynamic pricing or peak penalties; limited surplus | Arbitrage, peak shaving | Peaks drive costs; little PV export |

| Hybrid (PV + grid) | Variable loads + changing prices + mixed seasons | Stacking savings, flexibility | Some surplus sometimes; meaningful price spreads and/or peaks |

For many commercial sites, a hybrid strategy is the most robust because it captures value in multiple operating conditions (Energy Toolbase, Mayfield Renewables).

How to choose the right charging strategy (a practical checklist)

You don’t need perfect data to decide the direction, but you do need the right “signals.”

1) Check your PV surplus profile

Look at 15-minute (or hourly) data for:

- How often PV exceeds load

- How many kWh are exported on typical weekdays vs weekends

If surplus happens most sunny days, surplus storage is likely a strong baseline.

2) Identify your expensive hours

From your tariff or market-based contract:

- When are your highest prices?

- Are there predictable peak windows?

- Do you have demand-based charges?

If your expensive hours are consistent, grid charging + planned discharge can help.

3) Find your peaks (and their duration)

Batteries are great at shaving short-to-medium peaks. If your peaks last 6–10 hours every day, the economics change—then you may be looking at a bigger system or different operational changes.

4) Decide what you want to “optimize first”

A clear priority avoids conflicting settings:

- Maximum self-consumption?

- Lowest bill?

- Lowest peak?

- Lowest carbon at the meter?

An EMS should support the priority you actually care about—not just a generic mode.

What data do you need to calculate ROI?

To accurately calculate energy storage savings, you need:

- Energy consumption profile (hourly or 15-minute intervals) or invoices + interval data

- Tariff / pricing model (fixed vs dynamic)

- Contracted power / peak demand information

- Existing PV installation details (kWp, production, self-consumption)

Implementation tips that improve results (without buying more battery)

These are “no-regrets” improvements that often lift savings regardless of strategy.

Shift flexible loads into solar hours

Examples:

- EV fleet charging (or part of it)

- HVAC pre-heating/pre-cooling

- Non-critical process loads

Even basic load shifting can reduce exports and increase direct PV usage—often cheaper than adding extra kWh of battery.

Use a hybrid rule set with export limits

Many sites benefit from:

- “No export unless battery is full” rules

- “Reserve X% SoC for peaks” rules

- “Charge from grid only below price threshold” rules

These types of EMS value-capture mechanisms are common in commercial solar + storage guidance (Energy Toolbase).

Plan for seasonality

If you size and schedule only for summer, you may be disappointed in winter performance. Hybrid control helps because it can adapt: more self-consumption in summer, more arbitrage/peak shaving in winter.

Who is ESS + PV strategy optimization for?

This topic is most relevant for:

- Facility managers with PV installations who see frequent exports and want to increase self-consumption.

- Energy managers managing tariffs, peaks, and operational schedules.

- Sustainability officers tasked with improving on-site renewable usage and reducing grid imports.

- Growing businesses planning PV expansion and wanting a future-proof ESS strategy (hybrid control is often best here).

If your site already has PV, strategy matters even more—because the battery is not replacing the PV investment, it’s unlocking more value from it.

FAQ (Frequently Asked Questions)

-

Is storing PV surplus always better than exporting it?

Not always. It depends on the gap between your import price and export compensation, plus battery losses and cycling. When export value is low, surplus storage usually improves savings; when export is well-paid, the benefit can shrink. -

Can a battery charge from both PV and the grid?

Yes—many commercial systems support hybrid operation. The key is EMS rules that prevent “charging at the wrong time” and prioritize the highest-value use cases (Energy Toolbase). -

What’s the simplest ESS + PV strategy to start with?

If you have consistent daytime PV surplus, start with PV surplus storage (self-consumption mode). It’s intuitive and often immediately reduces exports (Solar-Electric.com). -

When does grid charging make sense for a business with PV?

When price spreads are meaningful (ToU/dynamic pricing) and/or peaks are costly, and when PV surplus alone doesn’t create enough battery cycles to justify the system. Commercial storage value often comes from arbitrage + peak shaving (Mayfield Renewables). -

Can ESS really increase self-consumption close to 100%?

In some cases and with careful sizing and constraints, very high self-consumption is possible, but it’s not always the most economical target. Research discussions emphasize sizing and operational assumptions heavily influence feasibility (PV Magazine). -

Do I need an AI-based EMS to get value from PV + ESS?

You can start with simple modes, but businesses typically see better long-term results when scheduling adapts to load changes, weather variability, and price signals. This is where AI-driven automation reduces manual work and protects ROI. -

What’s the biggest mistake businesses make with PV + battery projects?

Choosing battery size and strategy without using interval data. A battery that looks good on annual totals can underperform if your peaks are short, your surplus is weekend-heavy, or your tariff structure rewards different behaviors.

Summary

ESS with solar is not one “best setup”—it’s a set of charging strategies. PV surplus storage is ideal when you export midday and import later. Grid charging adds value when you face strong price spreads or expensive peaks. Hybrid strategies are often the most reliable because they stack benefits and adapt to seasonality and operational changes, especially when controlled by a smart EMS.

If you already have PV, the fastest path to better economics is usually: quantify your surplus, identify your peak cost drivers, and choose the strategy (or hybrid rules) that converts the most expensive grid kWh into on-site energy.

Next steps

If you want to see which strategy fits your facility and what the payback can look like with your tariff and PV profile:

- Calculate ROI for PV + ESS → (2 minutes)

- Learn how AIESS makes storage 100% automatic and easy to implement with existing systems: View our offer →

Related articles

- What is an energy storage system (ESS) and how does it work?

- Peak shaving with BESS: how businesses cut demand peaks

- Energy arbitrage explained: when charging from the grid pays off

- How to size a commercial battery for PV self-consumption

Sources and References

Article based on data from:

- Energy Toolbase (2023–2026). “The Five Ways an Energy Management System (EMS) Can Capture Value for Solar + Storage Assets.”

https://www.energytoolbase.com/blog/energy-storage/ems-can-capture-value-for-solar-storage-assets/ - Solar-Electric.com (2024–2025). “Energy Storage & Sustainable Energy: Bridging Gaps.”

https://www.solar-electric.com/learning-center/ess-bridging-the-gap/ - Anern (2025). “Maximizing Self-Consumption with a Solar ESS.”

https://www.anernstore.com/blogs/diy-solar-guides/maximizing-self-consumption-with-solar-ess - Mayfield Renewables (2024–2025). “Top 3 Reasons ESS Makes Commercial PV Cost-Effective.”

https://www.mayfield.energy/technical-articles/top-3-reasons-ess-makes-commercial-pv-cost-effective/ - AlphaESS (2025–2026). “How to Maximize ROI from Commercial and Industrial Energy Storage.”

https://www.alphaess.com/how-to-maximize-roi-from-commercial-and-industriai-energy-storage - PV Magazine (2024–2026). “PV system sizing for 100% self-consumption.”

https://www.pv-magazine.com/2024/10/02/pv-system-sizing-for-100-self-consumption/

Last updated: January 25, 2026