Dynamic tariffs & smart energy buying: when ESS earns the most

Dynamic tariffs enable energy arbitrage: charge your ESS at low hourly prices, use it at peaks, and boost savings with AI automation. Check ROI.

Dynamic tariffs & smart energy buying: when ESS earns the most

Dynamic tariffs make energy arbitrage practical: you buy electricity at low hourly prices, store it in an ESS/BESS, and use (or sometimes export) that energy when prices peak. This article is for energy managers, CFOs, and advanced users already on (or considering) dynamic tariffs who want a clear, numbers-first view of where arbitrage profits really come from. You’ll learn how arbitrage works in day-ahead markets, what typically limits savings in real operations, and why AI energy management is often the difference between “nice idea” and repeatable results.

Dynamic pricing is powerful—but it’s also unforgiving. Miss the cheap window, hit the battery too hard, or ignore fees and you can erase the margin. That’s why automation matters: arbitrage is a daily optimization problem, not a one-time setting.

What are dynamic tariffs?

Dynamic tariffs are electricity contracts where your energy price changes over time—often hourly—reflecting wholesale market conditions plus retailer costs, grid fees, and taxes (structure varies by country and supplier). In practice, many dynamic contracts are indexed to day-ahead hourly energy prices (set in advance for each hour of the next day), so you can plan charging and consumption around predictable price signals.

Dynamic tariffs are becoming more common across Europe because they help shift demand to periods with abundant wind/solar generation and lower system stress (Clean Energy Wire). For businesses, the value proposition is straightforward:

- When prices are low: consume more, charge batteries, run flexible processes

- When prices are high: use stored energy, reduce grid import, shave peaks

Dynamic tariffs vs Time-of-Use (ToU): what’s the difference?

Both are “time-varying,” but they behave differently.

| Feature | Time-of-Use (ToU) tariff | Dynamic (hourly) tariff |

|---|---|---|

| Price schedule | Fixed blocks (e.g., peak/off-peak) | Changes hour-by-hour |

| Forecastability | Very high | High (day-ahead) but more variable |

| Arbitrage potential | Moderate | Often higher (more volatility) |

| Operational effort | Low | Medium to high without automation |

ToU can be a great first step. But if your contract exposes you to hourly energy prices, the upside (and complexity) increases.

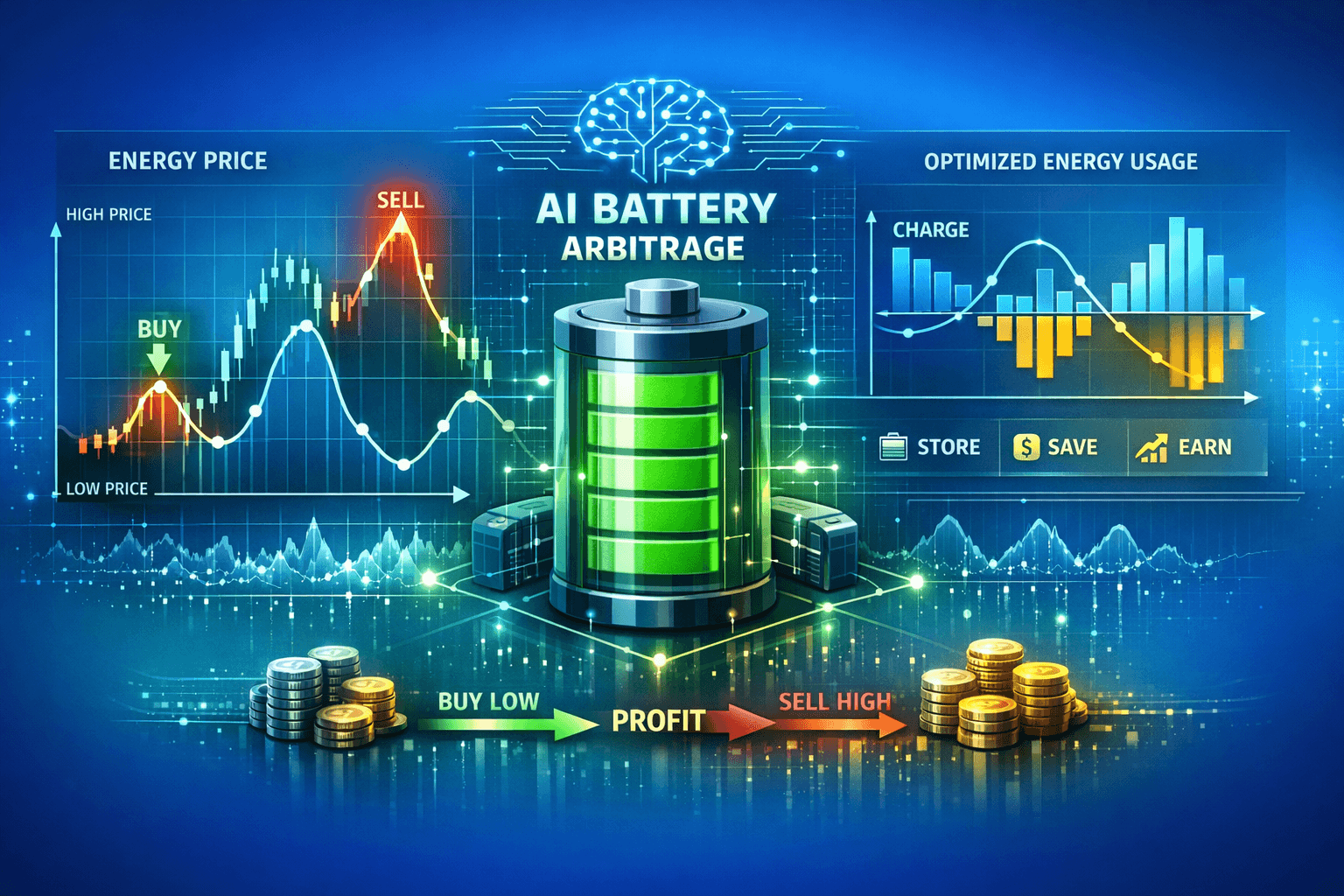

What is energy arbitrage (and why ESS is built for it)?

Energy arbitrage is the practice of buying electricity when prices are low, storing it, and then using or selling it when prices are higher (gridX; FlexPower). In a business setting, “selling” is often less important than avoiding expensive imports at peak hours.

Battery storage is increasingly used for arbitrage because it can respond fast and cycle frequently compared to many other flexibility assets (Zion Technology).

The simplest arbitrage equation (what most people forget)

At a high level, arbitrage margin per 1 kWh delivered later is:

Margin ≈ (High price) − (Low price) − (losses) − (fees) − (battery wear cost)

Where:

- losses = efficiency losses (charge/discharge + inverter)

- fees = contract components that may not be arbitrageable (varies by tariff)

- battery wear cost = the “hidden” cost of cycling (degradation)

If you ignore the last two, arbitrage looks amazing on paper and disappointing in reality.

How does ESS arbitrage work with hourly energy prices?

On dynamic tariffs, an ESS typically follows a daily schedule:

- Forecast the next day’s hourly prices (day-ahead curve)

- Identify cheap hours (charge windows) and expensive hours (discharge windows)

- Respect operational constraints:

- battery state of charge (SoC) limits

- power limits (kW)

- energy capacity (kWh)

- required reserve (e.g., backup, peak shaving)

- Execute automatically and adjust if real consumption deviates

A practical example (C&I site without PV)

Assume:

- Battery round-trip efficiency: 88–92% (typical for modern BESS; site-specific)

- Spread between cheap and expensive hours: 0.10 €/kWh

- Effective delivered spread after losses: ~0.10 × 0.90 ≈ 0.09 €/kWh

- Minus battery wear cost + non-shiftable fees: maybe 0.02–0.05 €/kWh

Result: real margin can be 0.04–0.07 €/kWh—still valuable, but only if you cycle meaningfully and consistently.

This is why the “when ESS earns the most” question matters: arbitrage is a function of volatility, battery utilization, and operational discipline.

When does ESS earn the most on dynamic tariffs?

ESS arbitrage tends to be strongest when these conditions align:

1) High price volatility (large hourly spreads)

More wind/solar in the grid often increases price swings—sunny or windy hours can push prices down, while evening peaks can be expensive (Clean Energy Wire; PV Europe). The bigger and more frequent the spreads, the more opportunities a battery has.

Rule of thumb: If your spread is smaller than the combined cost of losses + wear + non-arbitrageable fees, you should not cycle for arbitrage that day.

2) You can shift enough energy (kWh) at the right time (kW)

Two sites can have the same battery but different results:

- Site A has peaks that align with the most expensive hours → high value

- Site B’s load is flat → battery may run out of “useful discharge moments”

A battery earns from arbitrage only when it displaces grid import during high-price hours (or enables exports at higher value where allowed).

3) Your tariff structure allows savings to flow through

Not every bill component follows the wholesale price. In many markets, taxes, fixed fees, and some network charges are not reduced by shifting energy. That means:

- Arbitrage works best when a large share of your per-kWh cost is time-variable

- Savings are lower if most of your cost is fixed or capacity-based

This is one reason why site-specific simulations are more reliable than generic payback claims.

4) Your operations are “flexible enough” (even without process changes)

You don’t need to shut down production to benefit. But you do need:

- stable metering data

- predictable constraints (e.g., when you must keep reserve)

- a battery sized to your load shape

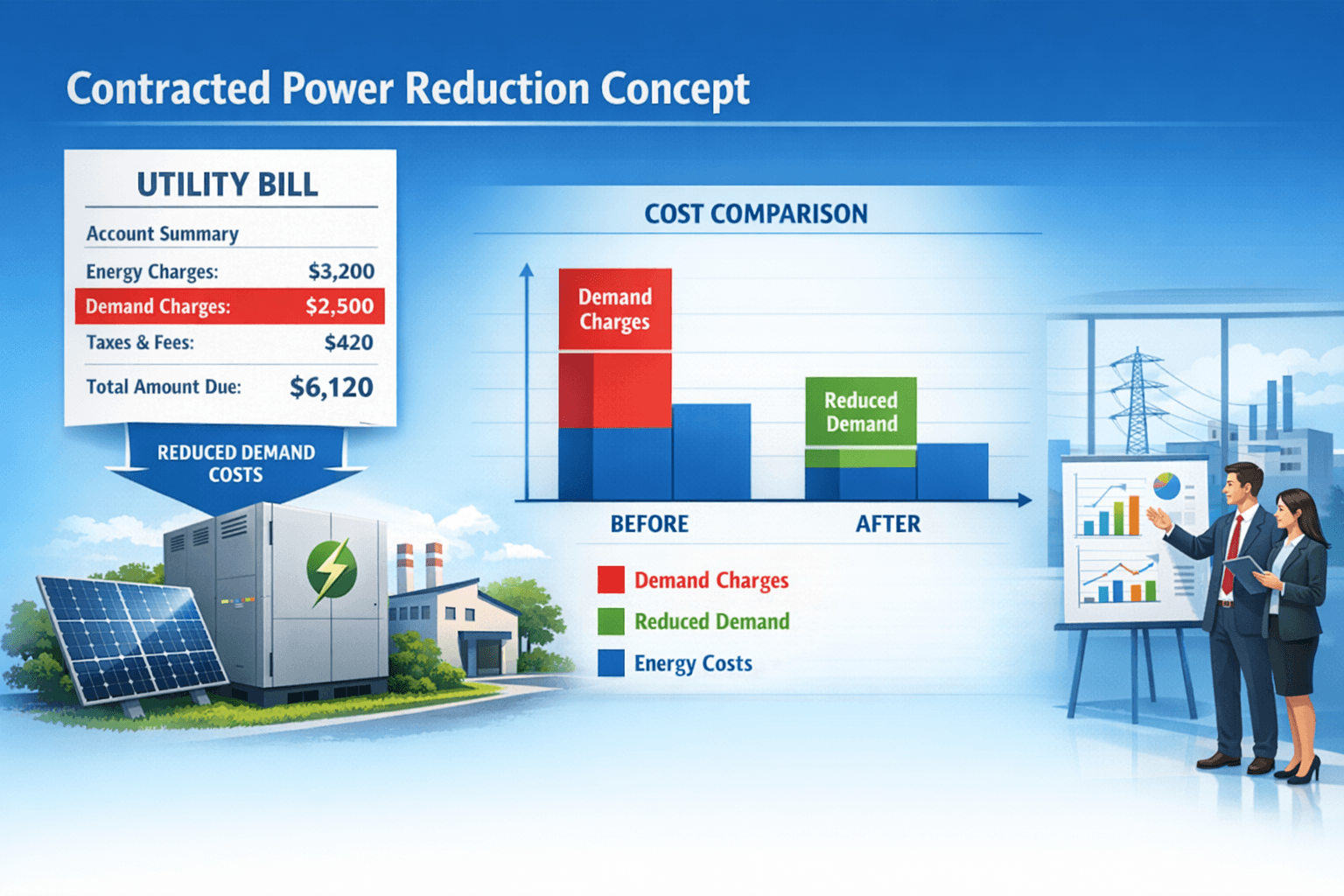

5) You combine arbitrage with peak shaving (stacking value)

For many commercial sites, arbitrage alone can be good, but arbitrage + peak shaving is often better. The battery:

- charges when energy is cheap

- discharges when energy is expensive and your demand is high

This “stacking” increases effective value per cycle because the same discharge can reduce both energy cost and demand-related costs (where applicable).

The real-world risks (and how to manage them)

Dynamic tariffs reward discipline. The main risks are operational and contractual, not theoretical.

Risk 1: Transaction costs and “hidden” bill components

If there are costs you can’t avoid by shifting energy (or costs that increase with import/export), your spread shrinks. Research on electricity market arbitrage shows that high transaction costs can prevent profitable arbitrage even when price differences exist (EIEF / Mercadal PDF).

How to manage it

- Break your bill into components: what is hourly-variable vs fixed?

- Model arbitrage on the real marginal price you pay per kWh per hour

Risk 2: Forecast error and schedule mismatch

Day-ahead prices are known, but your load is not guaranteed. If production shifts or an unexpected peak occurs, you can end up:

- discharging too early and buying expensive power later

- charging when you actually needed that capacity for a peak

How to manage it

- Use control logic that adapts to real load, not just prices

- Keep a minimum SoC reserve when your site is peak-sensitive

Risk 3: Battery degradation (cycling too aggressively)

Every cycle has a cost. Arbitrage should only cycle when the expected margin exceeds the degradation cost.

How to manage it

- Use cycle-aware optimization: treat battery wear as a “cost” in the decision

- Prefer strategies that maximize profit per cycle, not just number of cycles

Risk 4: Regulatory and tariff changes

Rules for storage, exports, and market participation evolve (and differ across EU countries). Your strategy must remain robust when:

- grid fees change

- export compensation changes

- contract terms change

Dynamic tariffs and market access rules directly influence arbitrage viability (Zion Technology).

How to manage it

- Avoid strategies that depend on a single regulation “loophole”

- Re-evaluate the model after contract renewal or regulatory updates

Risk 5: Operational complexity (manual control doesn’t scale)

If your team tries to “trade” manually:

- you’ll miss opportunities

- you’ll make inconsistent decisions

- you’ll spend time that rarely justifies the marginal gain

This is exactly why automation and AI energy management matter.

Why automation (AI) improves arbitrage results

Dynamic tariffs create a repeatable optimization problem:

- decide when to charge/discharge

- decide how much to charge/discharge

- respect constraints and uncertainty

- re-optimize when reality changes

Humans can do this occasionally. Computers can do it every day, every hour.

AI-driven control is especially valuable because it can:

- learn your site’s consumption patterns (weekday vs weekend, seasonality)

- incorporate forecasts (prices, PV, load) and update decisions automatically

- avoid low-margin cycles by pricing in efficiency and degradation

- coordinate multiple goals: arbitrage + peak shaving + PV self-consumption

This matches the broader concept that dynamic contracts help demand follow supply—especially during high renewable generation—and automated systems can optimize that matching continuously (Clean Energy Wire).

What “AI energy management” should do in practice

A good controller for dynamic tariffs should:

- Minimize your effective energy cost, not just shift kWh

- Use the correct marginal price (your tariff reality, not a headline market price)

- Respect operational priorities (production continuity > savings)

- Be explainable (CFO-ready reporting: why the battery did what it did)

At AIESS, our focus is exactly this: 100% automatic, easy-to-implement battery optimization that works with existing systems—so your team doesn’t need to become energy traders.

Quick self-check: are you losing value without automation?

If any of these are true, automation typically pays back fast:

- You check prices “sometimes” but not daily

- Your load changes week-to-week

- You already have PV and curtailment / export limitations

- You have demand peaks that are expensive or operationally risky

Applications of dynamic-tariff arbitrage (beyond “buy low, use high”)

Arbitrage becomes more powerful when combined with other flexibility assets.

ESS + PV (self-consumption and “solar shifting”)

With PV, a battery can:

- store midday PV generation (often when prices are low)

- discharge later when prices and consumption are higher

This aligns with the idea that time-varying export/import values can change prosumer economics, so you want a controller that optimizes for your contract’s rules—not generic assumptions (PV Europe).

ESS + flexible loads (industrial processes)

Some processes are inherently shiftable:

- HVAC pre-cooling/heating

- compressed air

- non-critical pumping

- charging fleets (EVs, forklifts)

Even small flexibility reduces the battery size needed to achieve the same savings.

Aggregation and VPP (where available)

In some markets, assets can be aggregated into a virtual power plant. This can open additional revenue streams, but it also adds contractual complexity. For most SMBs, starting with behind-the-meter arbitrage + peak shaving is the simplest “high certainty” stack.

A simple “when does it pay?” framework (CFO-friendly)

Instead of asking “How big should my battery be?”, start with three questions:

-

How volatile are my hourly prices?

Look at the distribution of hourly spreads across months. -

How much energy can I realistically shift?

Battery capacity (kWh) must match your expensive-hour demand volume. -

What is my true marginal cost per hour?

If only part of your bill is time-variable, arbitrage impact is capped.

Practical sizing logic (quick table)

| Your situation | What usually matters most | Typical strategy focus |

|---|---|---|

| Dynamic tariff, no PV, high evening peaks | Price spreads + peak hours alignment | Arbitrage + peak shaving |

| Dynamic tariff + PV, midday overproduction | PV capture + evening discharge | Self-consumption + arbitrage |

| Flat load, small spreads | Limited arbitrage value | Focus on demand charges/backup |

| Highly variable operations | Forecast accuracy & adaptive control | AI automation + reserve management |

This is exactly why simulation on your own data is the fastest way to validate value.

What data do you need to calculate ROI?

To accurately calculate energy storage savings, you need:

- Energy consumption profile (hourly or 15-minute intervals) or invoices + interval data

- Tariff / pricing model (fixed vs dynamic)

- Contracted power / peak demand information

- Existing PV installation details (kWp, production, self-consumption)

Benefits of ESS on dynamic pricing (what you can realistically expect)

When done correctly, ESS arbitrage under dynamic tariffs can deliver:

- Lower energy purchase cost by shifting imports to cheaper hours

- More predictable budgeting (less exposure to peak hours)

- Peak shaving benefits (where demand charges or peak-related costs apply)

- Better use of PV (more self-consumption, less wasted production)

- Operational simplicity with automation: fewer manual decisions

Some studies and market observations suggest that users who actively adapt consumption to dynamic prices can save materially versus passive behavior (e.g., reported savings up to 34% for households under certain assumptions, excluding fees and taxes) (Clean Energy Wire). For businesses, the achievable percentage depends heavily on load profile, tariff structure, and the share of costs that is truly time-variable.

Who is ESS arbitrage for?

Energy arbitrage with ESS is usually a good fit if you are:

- An energy manager responsible for lowering operational costs

- A CFO evaluating investments with measurable cashflow impact

- A facility with dynamic tariffs / hourly energy prices

- A site with clear peaks or PV production mismatch

- An organization that prefers automation over manual trading

It’s a weaker fit if your tariff is mostly fixed, your hourly spreads are consistently small, or your site has minimal flexibility and low peaks.

FAQ (Frequently Asked Questions)

-

Do dynamic tariffs always beat fixed-price contracts?

No. Dynamic tariffs can be cheaper when you can shift usage (or automate it), but they also expose you to high-price hours. A simulation using your load and tariff components is the safest comparison. -

Can I do energy arbitrage without exporting electricity to the grid?

Yes. Most commercial arbitrage value comes from avoiding expensive imports (buy low → store → use high), not necessarily selling back. -

How many cycles per day are “good” for arbitrage?

There is no universal number. What matters is profit per cycle after losses, fees, and degradation. Sometimes the best decision is to not cycle at all on low-spread days. -

What spread (difference between low and high price) is needed for profitability?

It depends on your efficiency, tariff structure, and battery wear cost. As a rule, the spread must exceed losses + non-arbitrageable costs + degradation cost. Modeling your marginal hourly cost is key. -

Why is AI energy management better than a fixed schedule?

Because prices, PV output, and consumption change daily. AI can re-optimize continuously, avoid low-margin cycles, and keep reserve for operational constraints—something manual control rarely achieves consistently. -

Does arbitrage increase battery degradation a lot?

Any cycling contributes to degradation. The right approach is to include degradation as a cost in optimization so the battery cycles only when expected savings exceed wear cost. -

Is arbitrage legal and supported in the EU?

In general, yes—though specific rules for grid access, fees, and export compensation vary by country and contract. National differences matter, and you should validate your tariff and local connection requirements.

Summary

Dynamic tariffs unlock energy arbitrage by exposing businesses to hourly energy prices: charge your ESS when electricity is cheap and use it when prices peak. ESS earns the most when price volatility is high, your load aligns with expensive hours, and your tariff structure allows the savings to flow through. The biggest real-world pitfalls are not the concept itself, but fees, forecast mismatch, and battery wear—which is why automation and AI energy management often deliver better, more consistent results than manual “energy trading.”

Next steps

If you’re already on dynamic pricing—or considering it—the fastest way to validate profitability is to run a simulation on your own consumption and tariff.

- Check simulation on your data →

- Learn what an AI-controlled ESS could do for your site: View our offer →

If you want a CFO-ready answer, focus on: hourly data, tariff breakdown, and peak constraints. AIESS can help you turn that into a clear business case—without turning your team into full-time traders.

Related articles

- What is an ESS (Energy Storage System) and how does it work?

- Peak shaving with battery storage: reduce demand peaks and costs

- Battery storage ROI: what drives payback time in commercial projects?

- PV self-consumption with BESS: how to use more of your solar energy

Sources and References

Article based on data from:

-

Clean Energy Wire (2024). “Q&A: What are dynamic electricity tariffs and why are they central to the energy transition?”

https://www.cleanenergywire.org/factsheets/qa-what-are-dynamic-electricity-tariffs-and-why-are-they-central-energy-transition -

gridX (2025). “What is Energy Arbitrage.”

https://www.gridx.ai/knowledge/what-is-energy-arbitrage -

FlexPower. “Arbitrage on the Power Market | Definition | Examples.”

https://flex-power.energy/school-of-flex/arbitrage/ -

Zion Technology (2025). “Energy Arbitrage Guide: Mastering Profits in 2025.”

https://ziontechnologies.co.nz/energy-arbitrage/ -

PV Europe (2025). “How dynamic tariffs could wake the sleeping giant of C&I storage.”

https://www.pveurope.eu/markets/how-dynamic-tariffs-could-wake-sleeping-giant-ci-storage -

EIEF / Mercadal (PDF). “Dynamic competition and arbitrage in electricity markets: The role of financial traders.”

https://www.eief.it/files/2016/02/02-jmp_mercadal-updated.pdf -

enjoyelec (2024). “Unlocking the Potential of Energy Arbitrage with Our HEMS.”

https://www.enjoyelec.net/unlocking-the-potential-of-energy-arbitrage-with-our-hems/

Last updated: January 28, 2026