ESS ROI for companies: how to calculate it and what data you need

ESS ROI step by step: 15-min consumption profile, peak power, tariff/distribution, PV, and savings scenarios. Calculate payback faster.

ESS ROI for companies: how to calculate it and what data you need

ESS ROI (energy storage ROI) is calculated by comparing your battery system’s net cost with the annual net savings it generates—mainly from peak shaving (demand reduction), time-based price optimization, and better use of PV energy.

This guide is for CFOs, financial analysts, and energy managers who need a clear, auditable way to estimate payback, ROI%, and risk before approving a battery energy storage system (BESS).

You’ll learn what data you actually need, how to structure scenarios, and how to avoid the most common ROI mistakes—then you can validate everything in minutes with a calculator.

Table of Contents

- ESS ROI — complete guide

- What data do you need to calculate ROI?

- Examples and scenarios

- ROI and savings

- How to get started?

- FAQ (Frequently Asked Questions)

- Summary

- Next steps

- Sources and References

ESS ROI — complete guide

Step 1: Define what “ROI” means in your company

In practice, decision-makers use 3 complementary metrics:

-

Simple payback period (years)

[ \text{Payback} = \frac{\text{Net CAPEX}}{\text{Annual net savings}} ]

This is the most common board-level metric and is widely used in storage ROI guides (e.g., Sunlith Energy, FFD POWER). -

ROI % over lifetime

[ \text{ROI}(%)=\frac{\text{Lifetime net benefit}-\text{Total cost}}{\text{Total cost}}\times 100 ]

A standard approach also described in industry ROI explainers (Humless, Etica AG). -

NPV (Net Present Value)

[ \text{NPV} = \sum_{t=1}^{N}\frac{\text{Net savings}_t}{(1+r)^t} - \text{Net CAPEX} ]

NPV is CFO-friendly because it accounts for the cost of capital and the timing of savings (see methodology discussions in Humless).

Recommendation for internal approval packs: show payback + NPV, and keep ROI% as an additional narrative KPI.

Step 2: Identify the “value streams” you will monetize

A company ESS/BESS rarely pays back from one source alone. Strong projects “stack” multiple value streams:

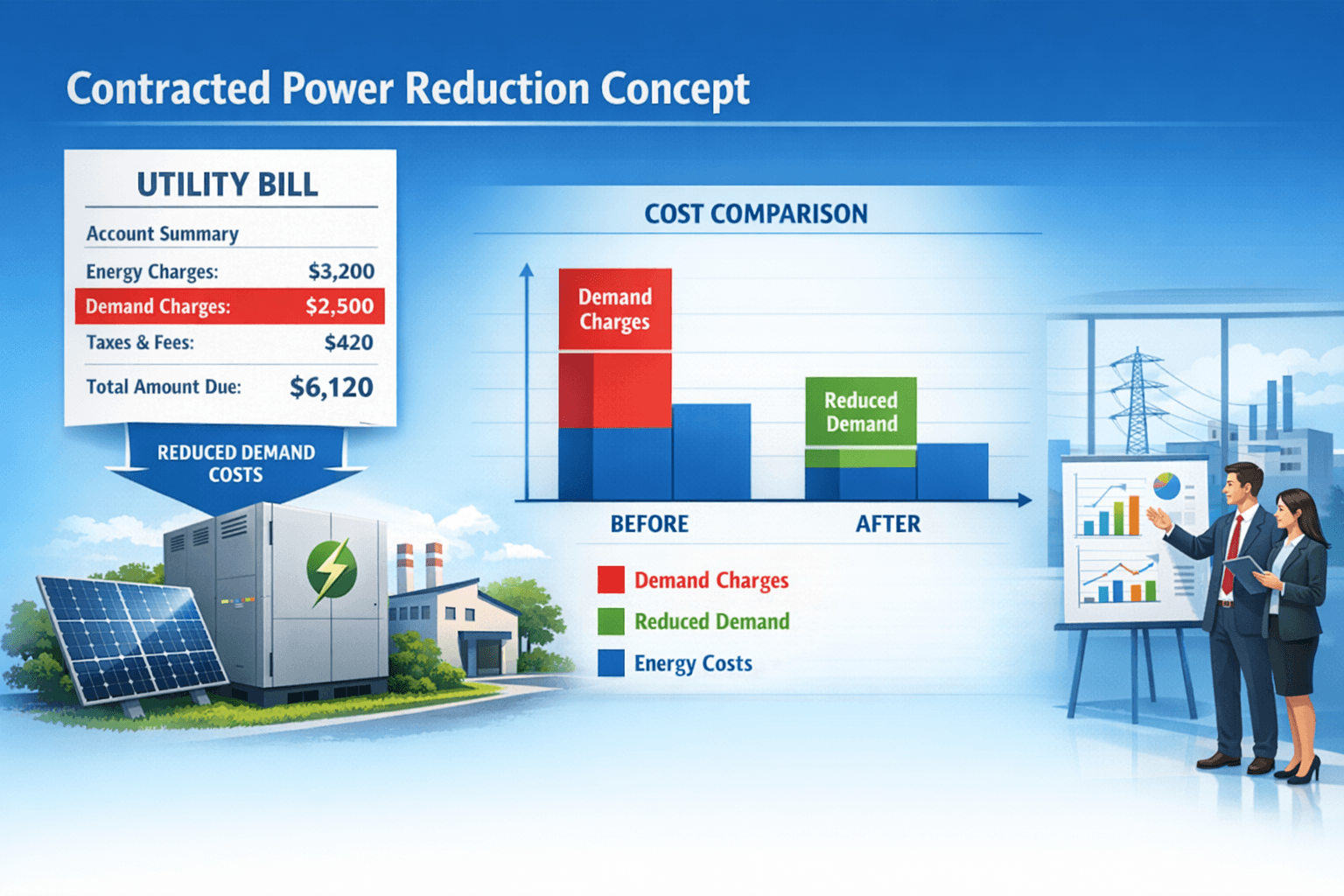

- Peak shaving (demand charge / peak power reduction): discharge during short peak windows to reduce billed peak demand (widely referenced in ROI guides such as FFD POWER).

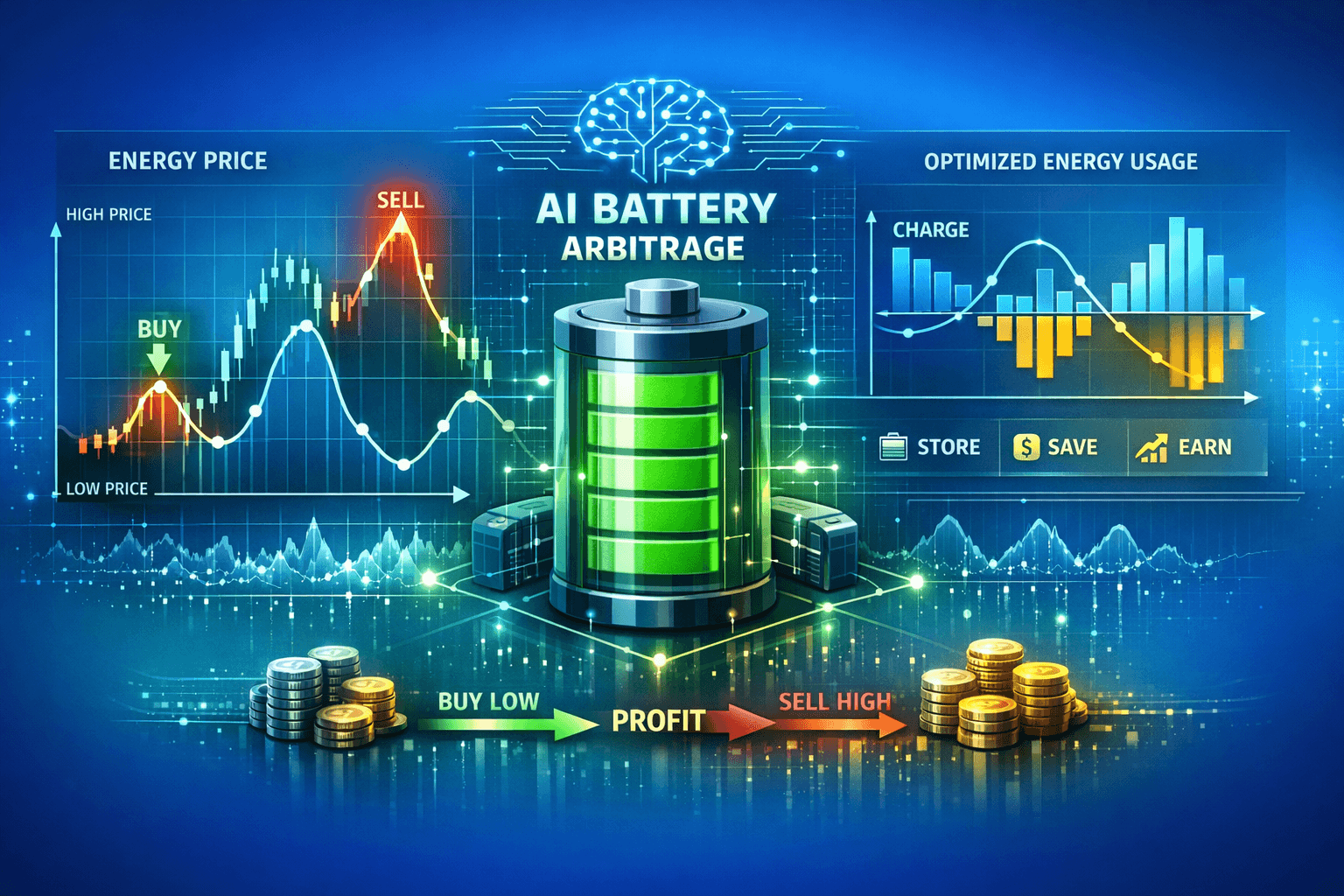

- Energy arbitrage / tariff optimization: charge when electricity is cheaper, discharge when it is more expensive (see modeling discussion at Aurora Solar).

- PV self-consumption uplift: store solar surplus and use it later to reduce grid imports; solar + storage modeling is a common ROI lever (Aurora Solar).

- Backup / resilience value: avoided cost of outages (lost production, downtime). Many ROI frameworks treat this separately because it depends on your risk assumptions (Etica AG).

- Grid services (where accessible): revenues or credits for providing flexibility services. Whether this is available depends on the market and your connection agreement (Etica AG).

Important: If your tariff is flat and your demand charges are low, ROI will usually be weaker. If your tariff has strong time differentiation and/or demand components, ROI tends to be much better (a recurring conclusion across ROI calculation guides like Humless).

Step 3: Choose the right time resolution (this is where most spreadsheets fail)

If you only use monthly invoices, you will miss the most profitable (and risky) part of BESS economics: the peaks.

For commercial ROI, you should model at least 15-minute intervals, because:

- peak power billing windows are often based on short intervals,

- production peaks can be very sharp,

- charging/discharging schedules depend on when peaks actually occur.

This is also why “15-minute profile” keeps showing up as a best practice in ROI calculation approaches (Humless).

Step 4: Convert technical performance into financial assumptions

To translate an ESS into savings, finance needs a few technical assumptions:

- Usable capacity (kWh) and power (kW)

- Round-trip efficiency (energy lost in charging/discharging)

- Depth of discharge policy (how aggressively you cycle the battery)

- Cycle life / degradation assumptions (capacity reduces over time)

- Operating strategy (peak shaving first vs arbitrage first vs PV-first)

Most “ROI surprises” come from one of two issues:

- the battery is sized for the wrong constraint (e.g., great kWh but not enough kW for peaks), or

- the strategy is not automated, so actual dispatch diverges from the model.

At AIESS, we focus on making operation 100% automatic—so the modeled strategy is much closer to reality in day-to-day use.

What data do you need to calculate ROI?

To accurately calculate energy storage savings, you need:

- Energy consumption profile (hourly or 15-minute intervals) or invoices + interval data

- Tariff / pricing model (fixed vs dynamic)

- Contracted power / peak demand information

- Existing PV installation details (kWp, production, self-consumption)

Examples and scenarios

Below are three CFO-friendly scenarios you can use to structure your analysis. They work whether you are in Poland or elsewhere in Europe—the principle is the same, only tariff items differ.

Scenario A: Peak shaving (demand-focused site)

Typical site: manufacturing, cold storage, facilities with high startup currents, compressed air, HVAC peaks.

How savings are created:

Battery discharges during the short intervals when your load would exceed the target threshold, reducing the billed peak. Many ROI guides highlight demand charge reduction as a core commercial value stream (FFD POWER).

Data you must have:

- 15-min load profile for at least 4–8 weeks (ideally 12 months)

- billed peak demand rules (how peak is measured and billed)

- contracted power penalties / overage charges, if applicable

Key risk to model: peak coincidence. If your peaks are frequent and long, you may need more energy (kWh). If peaks are short but very high, you need more power (kW).

Scenario B: Arbitrage (time-based pricing or market-indexed price)

Typical site: variable tariff, day-ahead indexed energy, strong spread between expensive and cheap hours.

How savings are created:

Charge in low-price periods and discharge during high-price periods. Solar + storage arbitrage and modeling practices are discussed in Aurora Solar.

Data you must have:

- tariff schedule (peak/off-peak windows) or indexed price data

- consumption profile (15-min is still best)

- constraints: maximum import/export, transformer limits

Key risk to model: spread consistency and operational limits. Not every day has a strong spread; you need scenario bands (conservative/base/optimistic).

Scenario C: PV + storage (self-consumption and peak control combined)

Typical site: existing PV or PV planned, especially where midday PV surplus is exported cheaply.

How savings are created:

- store PV surplus and use it later, reducing grid imports,

- optionally reduce peaks when PV drops (clouds) or after sunset.

PV + storage value modeling is a common approach for improving project economics (Aurora Solar).

Data you must have:

- PV size (kWp), inverter limits, export limits

- PV production profile (at least monthly; ideally interval)

- self-consumption rate today and constraints for shifting

A simple “inputs → outputs” map (useful in approval docs)

| Input category | What finance provides | What it enables in the model |

|---|---|---|

| Load data | 15-min consumption, peak records | Peak shaving potential, dispatch feasibility |

| Tariff & billing | energy rates, demand charges, distribution items | Arbitrage value, peak cost reduction |

| PV data | kWp, production/export, curtailment | Self-consumption uplift, reduced imports |

| CAPEX/OPEX | system cost, installation, O&M, financing | Payback, NPV, ROI%, sensitivity |

| Constraints | import/export limits, contracted power | Realistic savings (no “paper ROI”) |

ROI and savings

1) Calculate annual net savings (the auditable way)

At minimum, annual net savings should be:

[ \text{Annual net savings} = (\text{Peak shaving savings} + \text{Arbitrage savings} + \text{PV uplift} + \text{Other})

- (\text{O&M} + \text{Efficiency losses} + \text{fees}) ]

This “net savings” framing is consistent with standard ROI calculation approaches that define payback as investment divided by annual net savings (FFD POWER, Sunlith Energy).

Practical note: Treat “efficiency losses” as a cost of buying extra kWh to compensate for round-trip losses, especially in arbitrage-heavy strategies.

2) Payback period (simple and board-ready)

[ \text{Payback (years)} = \frac{\text{Net CAPEX}}{\text{Annual net savings}} ]

Many ROI primers use this exact structure and emphasize net cost (after incentives) and net savings as the core inputs (Humless, Sunlith Energy).

3) ROI% over lifetime (great for comparing projects)

[ \text{ROI}(%) = \frac{(\text{Annual net savings} \times \text{Years}) - \text{Total cost}}{\text{Total cost}}\times 100 ]

This is a commonly cited lifetime approach in ESS ROI explainers (Humless, Etica AG).

4) NPV (what finance teams trust most)

If you have a discount rate (WACC) and want a decision rule:

- If NPV > 0: the project creates value.

- If NPV < 0: it destroys value (unless you accept it for resilience/strategic reasons).

NPV-based reasoning is also referenced in ROI methodology discussions (Humless).

Worked example (illustrative, not a quote)

Assumptions (example only):

- Net CAPEX: €400,000

- Annual net savings: €80,000

- Lifetime: 15 years

Results:

- Payback: €400,000 / €80,000 = 5 years

- Lifetime net benefit: €80,000 × 15 = €1,200,000

- Simple ROI%: (€1,200,000 – €400,000) / €400,000 = 200%

This example structure mirrors common ROI walkthroughs used in commercial ESS discussions (Sunlith Energy, FFD POWER).

Sensitivity analysis: the 5 variables that move ROI the most

Create three cases (Conservative / Base / Optimistic) for:

- Peak demand savings (how much kW you can reliably shave)

- Price spread (for arbitrage sites)

- Battery utilization (cycles per day and dispatch discipline)

- Tariff changes / escalation (include at least a basic assumption)

- Net CAPEX (equipment + installation + grid works + commissioning)

Even a simple tornado chart in your internal model will make approval discussions faster.

Why AIESS? (and why automation matters for ROI)

Why AIESS?

AIESS energy storage systems stand out with:

- AI Control - automatic charge/discharge scheduling

- Forecasts - energy prices, weather, load predictions

- 24/7 Monitoring - savings reports and continuous optimization

For CFOs, the key point is this: a battery is only as profitable as its dispatch. AI-driven automation helps reduce the “model vs reality” gap—without your team spending time on daily operations.

How to get started?

1) Export the right datasets (minimum viable package)

- 15-minute consumption data (CSV is perfect)

- last 12 months of invoices

- tariff sheet (energy + distribution + demand items)

- contracted power / peak demand rules

- PV data if applicable (kWp + production/export)

2) Run a fast ROI pre-check

Use a calculator to validate whether you are in the right ballpark before commissioning a full engineering study:

Enter company data and calculate ROI →

3) Validate with a scenario you can defend

Pick the scenario that matches your business driver:

- Peak shaving first (if peaks are costly)

- Arbitrage first (if prices vary strongly by hour)

- PV-first (if you have PV surplus or export limits)

Then stress test your assumptions (conservative vs base vs optimistic).

4) Move from “ROI estimate” to “implementation plan”

A bankable plan typically includes:

- final sizing (kW/kWh) and connection constraints,

- commissioning plan (metering, data access),

- operational strategy (automated dispatch rules),

- measurement & verification (how savings will be tracked).

FAQ (Frequently Asked Questions)

-

What’s the difference between payback and ESS ROI?

Payback tells you how many years it takes for annual net savings to cover net CAPEX. ROI% measures how much net benefit you generate over the full lifetime relative to the investment (Sunlith Energy). -

Why do you need a 15-minute load profile? Isn’t a monthly bill enough?

Monthly bills hide short peak events and the real dispatch opportunities. A 15-minute profile lets you quantify peak shaving and realistic charge/discharge scheduling, which is central to commercial ROI methodology (Humless). -

What tariff items matter most for storage ROI?

Demand-related charges (peak kW), time-of-use spreads, and any penalties for exceeding contracted power. These are the components batteries can directly optimize (FFD POWER). -

Does solar always improve storage payback?

Not always, but PV often increases value by improving self-consumption and reducing grid imports—especially when export compensation is low or export is limited. Solar + storage modeling commonly shows this uplift (Aurora Solar). -

Should we calculate ROI using ROI% or NPV?

Use NPV if you want a capital-allocation view (discount rate, time value of money). Use payback for simple approval thresholds and ROI% for comparing projects with similar lifetimes (Humless). -

What costs are often missing in ESS ROI spreadsheets?

Installation and grid works, metering/communications, O&M, efficiency losses, warranty extensions, and sometimes commissioning time. Many ROI cost checklists stress “true cost components” beyond just battery hardware (Humless). -

What’s a “good” payback period for a company BESS?

It depends on your cost of capital and risk appetite, but commercial examples often target mid-single-digit years when tariffs and peaks are favorable. ROI guides frequently illustrate paybacks in that range for well-matched sites (FFD POWER). -

Can we start with a smaller system and expand later?

In many commercial designs, yes—modular systems allow scaling. It’s often a smart way to reduce initial CAPEX while validating savings with real operational data.

Summary

To calculate ESS ROI for a company, you need to (1) model annual net savings from peak shaving, arbitrage, and PV self-consumption, (2) subtract all operating and efficiency-related costs, and (3) compare the result to net CAPEX using payback, ROI%, and ideally NPV. The single most important input is a 15-minute consumption profile, because it reveals the peaks and dispatch windows that drive savings.

Next steps

If you want a fast, decision-ready estimate:

- Gather your 15-minute profile + tariff + peak/contracted power details

- Run an initial scenario (peak shaving, arbitrage, or PV-first)

- Validate results with a quick tool before deeper engineering work

Enter company data and calculate ROI →

See AIESS energy storage offer →

Related articles

- What is an energy storage system (ESS) and how does it work?

- Peak shaving explained: reduce demand charges with battery storage

- Commercial solar + storage: how to increase self-consumption and savings

- How AI optimizes energy storage dispatch in real time

Sources and References

Article based on data and methodologies from:

- Humless (2025). “How to Calculate ROI for Battery Energy Storage Systems.”

https://humless.com/blog/calculating-roi-battery-energy-storage - Sunlith Energy (2025–2026). “The Economics of BESS: A Practical Guide to Calculating ROI.”

https://sunlithenergy.com/economics-of-bess-calculate-roi/ - FFD POWER (2025–2026). “Energy Storage System Cost & ROI Analysis.”

https://ffdpower.com/the-cost-and-roi/ - Aurora Solar (2024–2025). “Optimize your ROI story with solar + storage modeling for energy arbitrage.”

https://aurorasolar.com/blog/optimize-roi-with-solar-storage-modeling-energy-arbitrage/ - Etica AG (2025–2026). “The Ultimate Guide to ROI for Battery Energy Storage Systems.”

https://eticaag.com/roi-for-battery-energy-storage-systems/

Last updated: January 13, 2026